July Market Wrap and Juicy Market Details.

- S. Hoyt

- Aug 7, 2023

- 2 min read

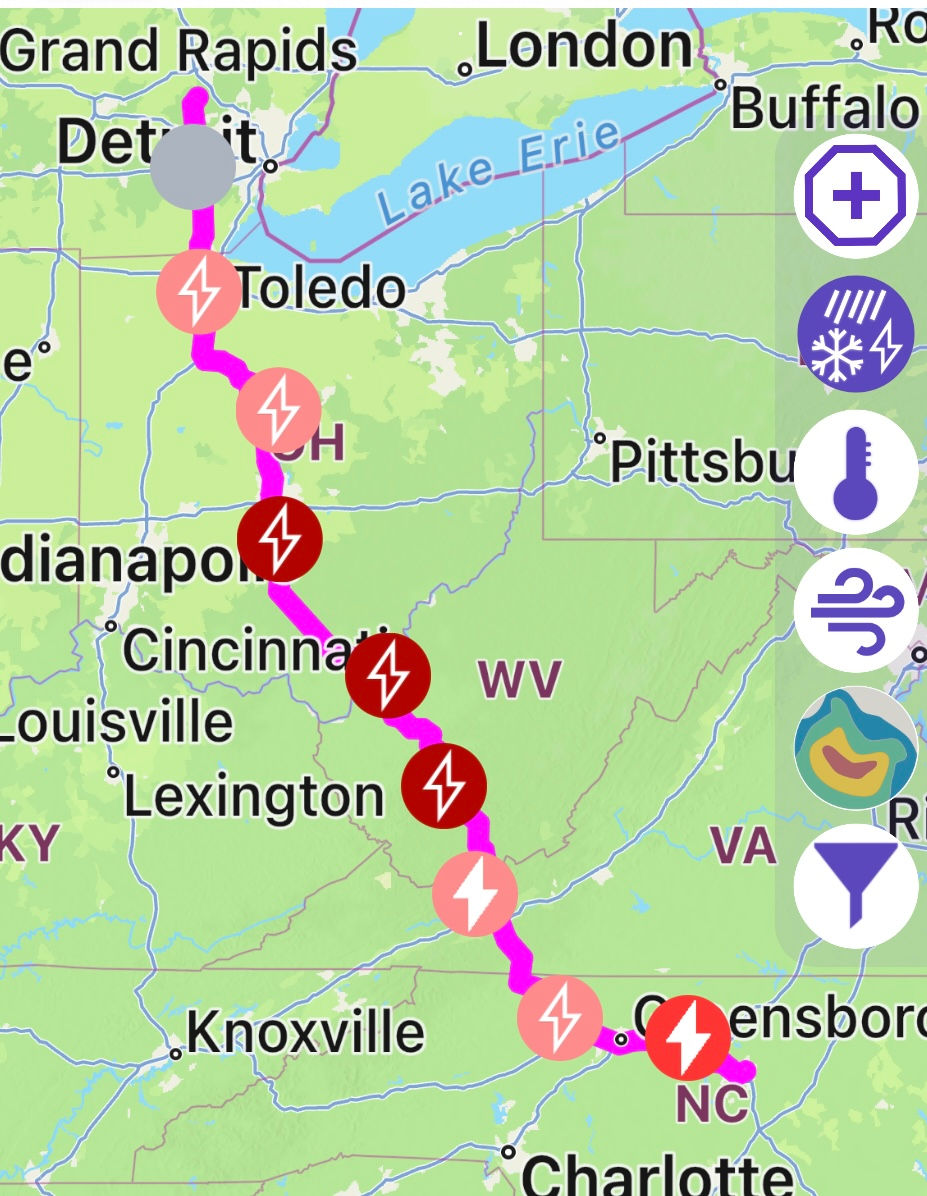

Metro Detroit, Raleigh North Carolina: Wrapping up July 2023 sales Numbers.

For real estate industry only: I buried the lede, scroll down.

Metro Detroit (Oakland, Macomb, Wayne Counties)

Average Sales Price UP to $317,913 from $314,625 in July of 2022

Unit Sales DOWN 21% to 3,658 from 4,710 in July of 2023.

Raleigh (Wake County)

Average Sale Price UP to $582,186 from $567,788 in July of 2022

Unit Sales DOWN to 1,406 from 1,735 in July of 2023.

Great market for homeowners, average prices are hovering at or near all time highs.

If you are in the industry, you are probably, as my daughters say, in your feelings.

Sales Volume is down 15% in Wake County year to date, and Detroit Metro is down 18.8%.

Last time I really talked about this with any urgency was in fall of 2006 in a Board meeting in Central Michigan, the universal response was "who cares". I did, I reforged my company and path and we survived the next three years and prospered in 2010, 2011 and 2012, no layoffs, no lost agents, no missed payments of any kind, a straight path to #1 in our market. We did lose our number one asset, our CTO left for an opportunity we could not match, our huge IP advantage lasted a while but that loss eventually turned us into the company I never wanted and I was out in 2018.

Why mention that? Identifying market influences is tough, understanding unintended consequences is extremely difficult. I knew why and what MOST of the unintended consequences were going to be, my peers did not. We were able to use this competitive advantage to recruit and grow.

The fundamentals of the market are different now, shrinking volume is a result of interest rates, people with 2.75% 30 year rates do not want to move.

But the impact on brokerages is exactly the same a huge drop in revenues compounded by greater agent demands and seriously declining ancillary service profits.

To put into perspective, the market as a whole in Detroit brokerages have shared a loss of over $14,500,000.00 in MONTHLY commissions this year versus 2022.

Wake County (Raleigh) has lost nearly $8,300,000.00 a MONTH in commissions.

If your business experiences a 16-19% drop in REVENUE how does that impact profit? (especially if the number of competitors grew)

How do those impacted downline react? Agents will search for higher splits, companies that recruited on "tools" and "support" have to watch cuts in order not to delete these promises or risk losing additional agents.

Now is about analyzing, adapting and executing at a high level.

I am happy to collaborate with your team to all three of these things plus assess current strengths and provide sustainable action plans with a path forward.

Bonus for reading to the end: Wake County will only see a $7,802,400 DECREASE in commissions in August of 2023 vs. August of 2022. (IF everything closes... which never happens).

Comments